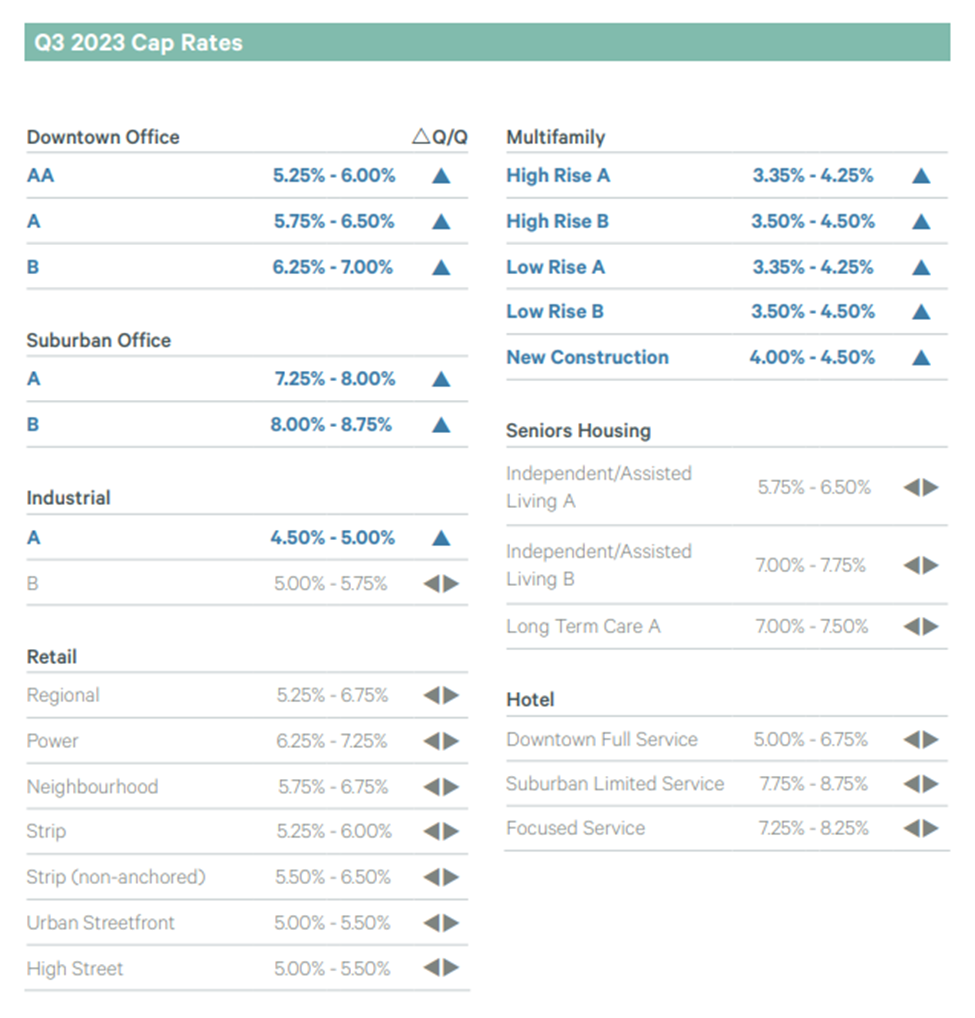

According to the CBRE’s Q3 2023 Canadian Cap Rate Report, Ontario’s multifamily sector has decompressed slightly, with the national average High Rise and Low Rise categories increasing 12 bps quarter-over-quarter to 4.55%.

This growth indicates a robust market. This trend suggests increased demand for multifamily properties, potentially leading to rising property values and providing opportunities for property owners. The accelerated growth may attract developers, fostering new projects and expanding the multifamily housing market.

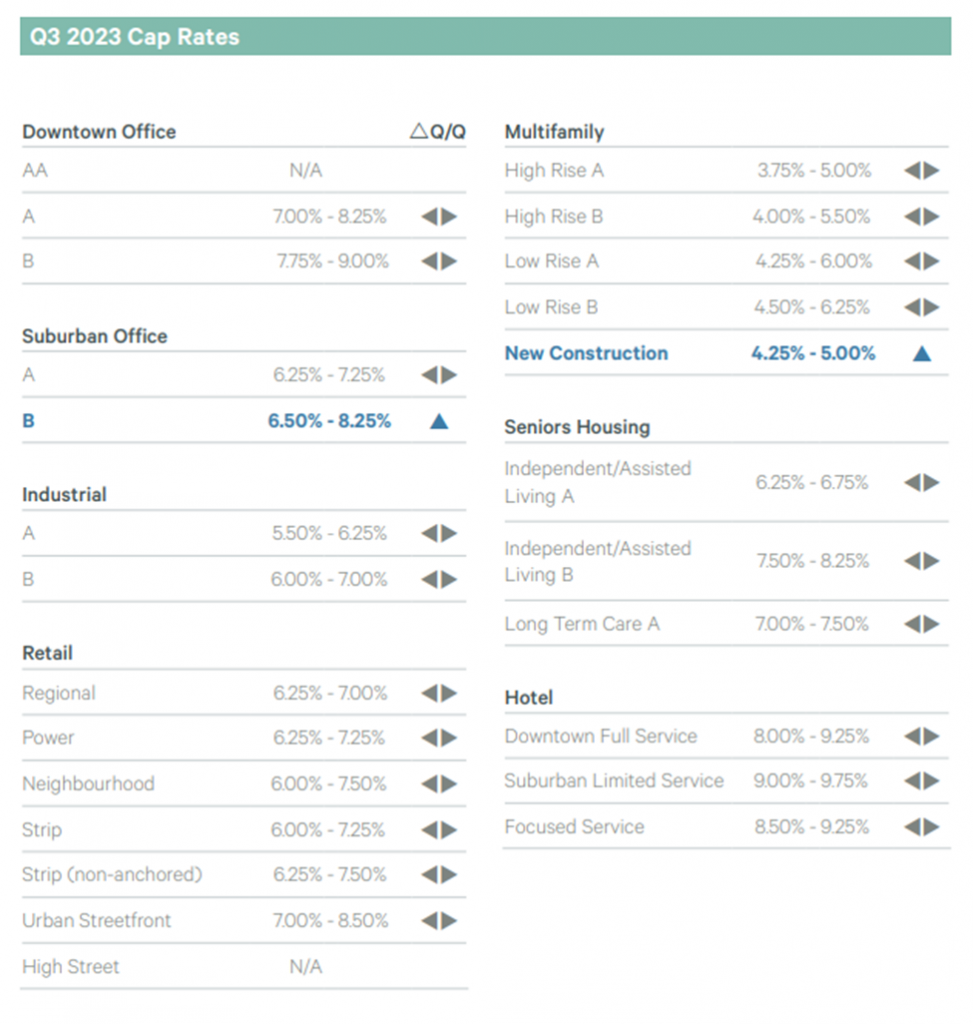

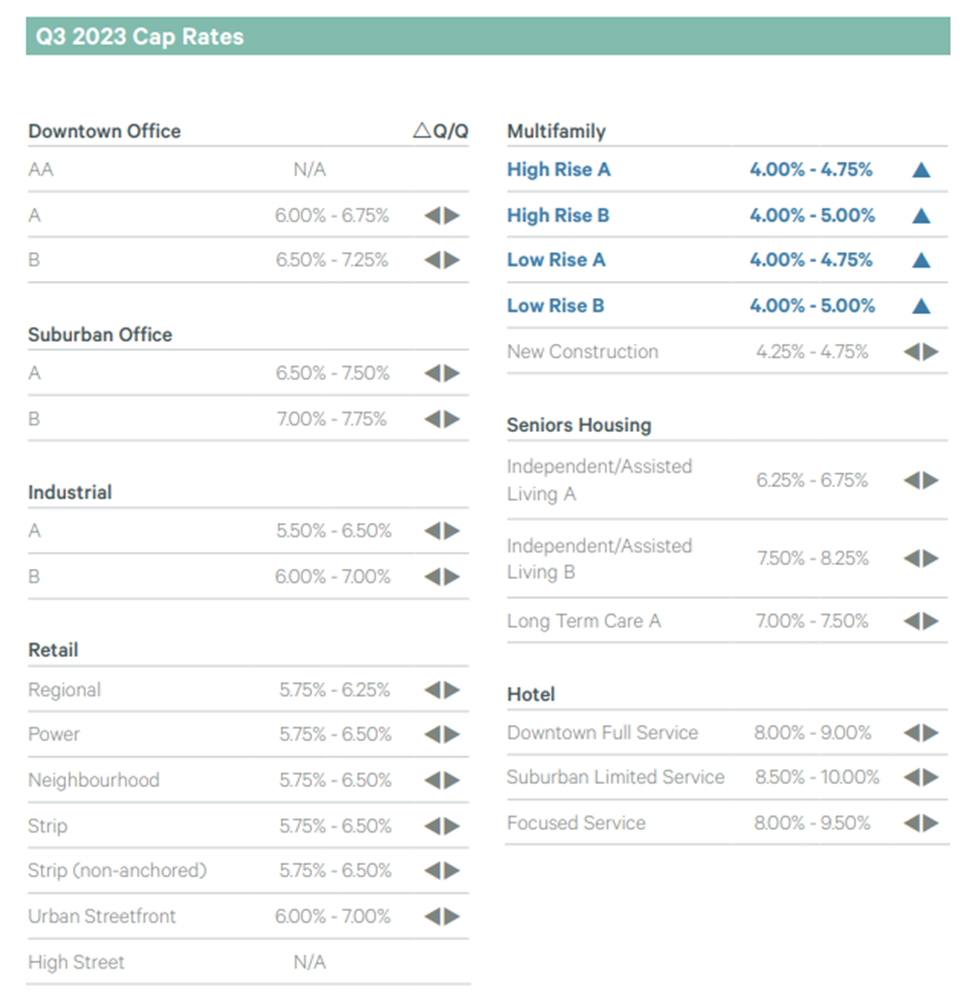

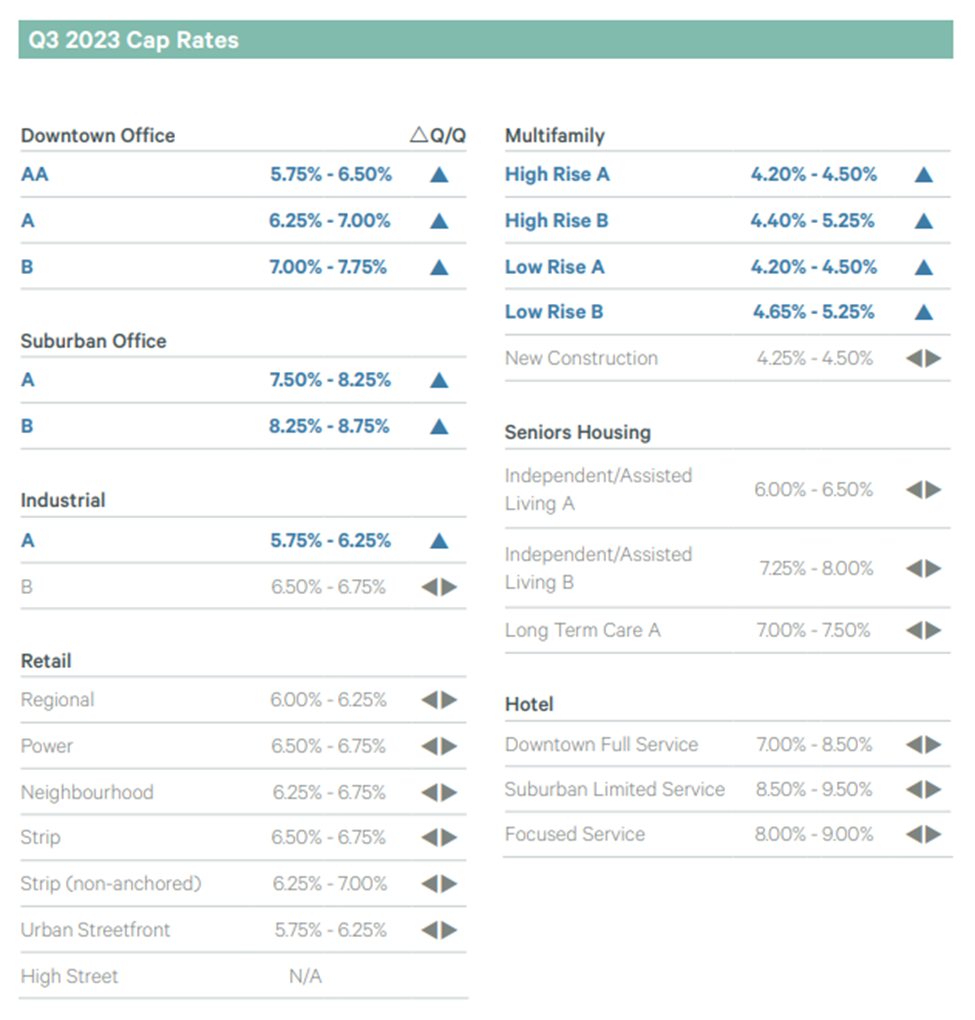

Following are some important multi-family graphs worth checking:

The report notes that Ontario’s strong economy and population growth continue to make it a desirable location for multifamily investment.

In conclusion, this positive trajectory points towards Ontario’s flourishing multifamily housing market. The province’s robust economy and continuous population growth contribute significantly to its appeal to investors. This could translate into an opportunity for real estate investors to enter the market at lower prices and an opportune time to maximize returns.